Ethereum Price Prediction: Institutional Momentum Targets $10,000 Amid Bullish Reversal

#ETH

- Technical Breakout Potential - ETH trading above key moving average with improving MACD momentum suggests near-term upside toward $4,800 resistance

- Institutional Accumulation Accelerating - Record validator queues and tokenized asset launches indicate growing institutional adoption supporting higher valuations

- Ecosystem Expansion Driving Demand - New financial products and simplified earning mechanisms creating additional utility and demand drivers for ETH

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

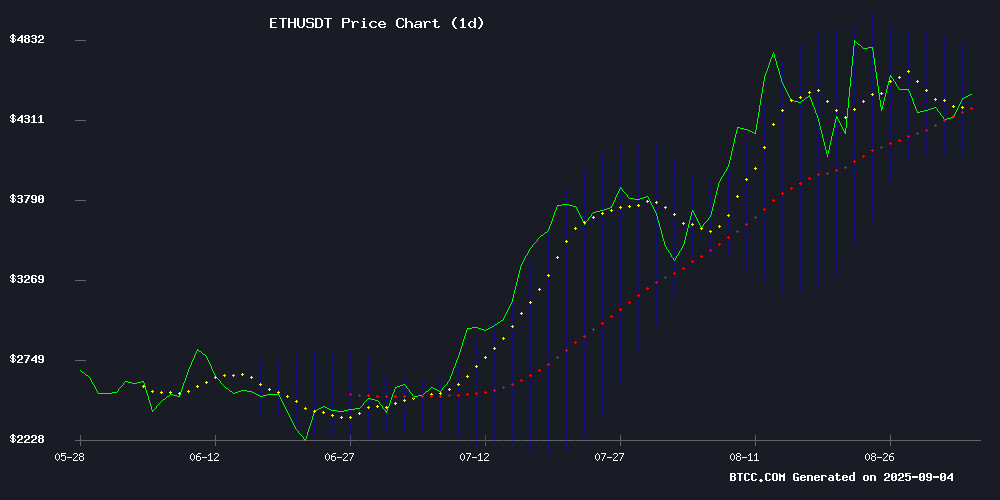

ETH is currently trading at $4,461.72, positioned above its 20-day moving average of $4,445.43, indicating underlying bullish strength. The MACD reading of -61.80 versus -82.59 signal line shows improving momentum despite negative territory, with the histogram turning positive at 20.79. Bollinger Bands suggest moderate volatility with price trading closer to the middle band, while the upper band at $4,812.10 presents a near-term resistance target.

According to BTCC financial analyst Sophia, 'The technical setup favors continued upward movement, with a break above $4,500 potentially accelerating gains toward the $4,800 resistance level. The moving average support combined with improving MACD momentum creates a favorable risk-reward scenario for bulls.'

Market Sentiment: Institutional Demand and Whale Accumulation Drive Optimism

Current market sentiment for ethereum remains strongly bullish, supported by multiple fundamental catalysts. Institutional accumulation patterns, the launch of tokenized traditional assets on Ethereum, and record validator queue levels indicate growing institutional adoption. The emergence of simplified earning products and strong August performance further reinforce positive momentum.

BTCC financial analyst Sophia notes, 'The convergence of institutional infrastructure development, whale accumulation resumption, and expanding DeFi offerings creates a fundamentally strong backdrop. While treasury model concerns exist, the overwhelming institutional demand and product innovation currently dominate market sentiment, supporting higher price targets.'

Factors Influencing ETH's Price

Hidden Red Flags In Ethereum Treasury Model Exposed

Sharplink Gaming co-CEO Joseph Chalom warns that Ethereum treasury firms chasing high yields may be underestimating risks reminiscent of the 2008 financial crisis. Despite Ethereum's bullish momentum, the rapid scaling of ETH Treasury models—with top 10 firms holding 3.6M ETH ($15.5B)—raises concerns about unsustainable practices.

Bitmine Immersion Tech leads with $8.1B in ETH holdings, while Sharplink follows at $3.6B. Chalom, a former BlackRock executive, cautions that aggressive accumulation strategies funded by equity or debt could backfire. "Companies are fixated on the last 1% of yield," he noted during a Bankless interview, drawing parallels to pre-crisis leverage excesses.

Proponents argue these treasuries boost ETH adoption, but data from Strategic ETH Reserve reveals concentrated exposure. Sharplink’s weekly ETH-per-share disclosures exemplify the transparency—and pressure—driving this high-stakes experiment in crypto corporate finance.

ETH Price Analysis - September 04, 2025

Ethereum's technical outlook suggests a pivotal moment as market dynamics shift. The asset shows resilience above key support levels, with on-chain metrics indicating accumulation by long-term holders.

Volatility compression points to an imminent breakout, likely catalyzed by institutional inflows into ETH-based financial products. Derivatives data reveals skewed positioning toward calls, reflecting bullish sentiment among sophisticated traders.

Ethereum Reclaims $4,400 as Institutional Accumulation Fuels $10K Prediction

Ethereum has surged back to $4,400, marking a critical recovery after weeks of volatile trading. The resurgence comes as institutional investors and Wall Street-backed funds aggressively accumulate ETH, signaling growing confidence in its long-term potential. Analysts now eye $10,000 as a plausible target should this momentum sustain.

Technical indicators reveal a pivotal juncture. ETH currently trades near $4,361, clinging to a crucial support zone between $4,220 and $4,280. A breach above the 50- and 100-EMAs at $4,450 could propel prices toward $4,600, while failure to hold support risks a retreat to $4,000. The RSI at 48 reflects neutral momentum, leaving room for decisive directional moves.

Beyond charts, the narrative centers on institutional adoption. On-chain data shows fresh accumulation, with heavyweight investors building positions. This fundamental strength, coupled with technical breakout potential, paints a bullish canvas for Ethereum's next leg up.

Pepeto Emerges as a Strong Contender Against BlockDAG and Unilabs Finance

Investors searching for BlockDAG are increasingly encountering mentions of Pepeto, an Ethereum-based project with tangible tools and transparent documentation. Unlike presale-heavy competitors, Pepeto offers immediate utility, including a zero-fee exchange demo, public audits, and clear staking terms. This practical approach positions Pepeto as a standout altcoin for 2025.

Pepeto's live demo of PepetoSwap and its cross-chain bridge in development highlight its operational readiness. The project leverages Ethereum's security and liquidity, appealing to those seeking real-world functionality over speculative promises. Staking terms and APY details are publicly available, reinforcing Pepeto's commitment to transparency.

Ondo Finance Launches Tokenized U.S. Stocks and ETFs on Ethereum for Non-U.S. Investors

Ondo Finance, a decentralized finance-focused asset manager, has introduced tokenized versions of over 100 U.S.-listed stocks and ETFs on the Ethereum blockchain. These digital assets are fully backed by real securities held at registered U.S. broker-dealers, offering non-U.S. investors access to fractional ownership and 24/7 trading outside traditional market hours.

The offering, branded as ONDO Global Finance, remains inaccessible to U.S. investors due to regulatory constraints. Ondo's recent acquisition of Oasis Pro—a licensed broker-dealer—streamlines asset backing but doesn't alter geographical restrictions. The move signals growing institutional interest in blockchain-based traditional asset representation.

Ethereum Validator Queue Hits Two-Year High Amid Institutional Demand

The backlog to become an Ethereum validator has surged to its highest level since September 2023, with 860,000 ETH ($3.7 billion) awaiting entry. Network congestion stems from ETF-driven institutional inflows and a resurgence in ETH treasury investments—a trend accelerated by the Shanghai upgrade's staking flexibility.

Validator onboarding remains bottlenecked by protocol constraints: just 900 new entrants daily against 1,800 exits. Analysts attribute the logjam to compounding factors—renewed staking demand, lower gas fees, and the gravitational pull of spot ETH ETFs, which have absorbed over $13 billion in fresh capital.

Lido Launches Simplified Earn Vaults with Veda and Mellow

Lido has introduced Earn, a new feature on stake.lido.fi designed to streamline access to curated strategy vaults for staked ether. The platform aims to simplify yield generation while maintaining robust security standards.

The inaugural offering, GG Vault by Veda Labs, provides single-click exposure to blue-chip DeFi strategies using ETH, WETH, stETH, or wstETH. A second vault focusing on decentralized validators, developed by Mellow, is scheduled for mid-September deployment.

Security protocols mirror Lido's Core requirements, mandating audits from reputable firms before listing. Automated monitoring systems enable rapid response to potential issues, including onchain pause mechanisms. While risk mitigation remains a priority, the Lido Ecosystem Foundation explicitly disclaims liability for user losses.

The fee structure maintains industry parity, with GGV implementing a 1% platform fee shared between Veda and Lido DAO. Users receive ERC-20 deposit tokens that accrue value, mirroring the wstETH model prevalent across DeFi ecosystems.

Ethereum Posts Strongest August Performance in Four Years Driven by Mega Whales

Ethereum surged 18% in August, marking its best performance for the month since 2021. The rally pushed ETH to a record high of $4,953, breaking a three-year streak of negative August returns.

Glassnode data reveals mega whales—entities holding 10,000+ ETH—were the primary force behind the uptick. These large investors accumulated 2.2 million ETH during the month before their buying momentum plateaued.

Mid-sized whales (1,000-10,000 ETH holders) resumed accumulation after a distribution phase earlier this year, adding 411,000 ETH in net inflows. The shift suggests renewed institutional and high-net-worth interest despite recent caution among the largest holders.

Ethereum Shows Bullish Reversal as Whales Resume Accumulation

Ethereum's market trajectory appears poised for a bullish reversal as on-chain data reveals renewed accumulation by large holders. Mid-sized whales holding 1,000-10,000 ETH have added approximately 411,000 ETH over the past month, signaling growing confidence despite a temporary pause from mega-whales holding 10,000+ ETH.

The cryptocurrency currently trades at $4,439.08, having gained 1.52% in the past 24 hours with $63.71 billion in trading volume. Technical analysts note Ethereum is testing key resistance levels—a decisive breakout above the bearish trendline could accelerate upward momentum.

Glassnode data highlights this divergence in whale behavior: while the largest holders took profits during August's rally, their mid-tier counterparts have returned as net buyers. 'When the sharks start feeding, it's usually time to pay attention,' remarked one trader monitoring the wallet movements.

How High Will ETH Price Go?

Based on current technical and fundamental analysis, ETH shows strong potential for significant upward movement. The combination of technical breakout patterns, institutional accumulation, and growing ecosystem development supports ambitious price targets.

| Timeframe | Target Price | Key Drivers |

|---|---|---|

| Short-term (1-2 months) | $4,800 - $5,200 | Bollinger Band breakout, MACD momentum shift |

| Medium-term (3-6 months) | $6,500 - $7,500 | Institutional ETF flows, validator growth |

| Long-term (12+ months) | $9,000 - $10,000+ | Tokenization adoption, ecosystem scaling solutions |

BTCC financial analyst Sophia emphasizes that 'The $10,000 prediction gains credibility from sustained institutional demand, though investors should monitor treasury model developments and broader market conditions that could impact this trajectory.'